New RMD Rules Give Retirement Savings More Time to Grow

The SECURE 2.0 Act, included in the federal spending bill passed in late 2022, dramatically changed the landscape for required minimum distributions (RMDs) from tax-deferred retirement accounts. As part of the effort to strengthen the nation’s retirement system, the Act increased the age to begin RMDs, providing the option to leave retirement savings untapped for a longer period of time. The legislation also eliminated the requirement to take lifetime RMDs from Roth accounts in employer plans.

Can’t Stay Tax-Free Forever

Contributions to tax-deferred retirement accounts are either made with pre-tax dollars, typically through a payroll deduction, or are tax deductible (up to the annual limit) if made directly. These accounts include traditional IRAs, SIMPLE IRAs, SEP IRAs, SARSEPs, and 401(k), 403(b), and government 457(b) plans.

Unfortunately, you cannot defer taxes indefinitely on the money you’ve accumulated in these accounts. The IRS requires that you take minimum distributions each year once you reach a certain age, whether you need the money or not. The RMD is the smallest amount you must withdraw each year, but you can always take more.

The SECURE 2.0 Act raised the RMD starting age to 73 beginning in 2023, and to 75 beginning in 2033. So you must begin taking annual RMDs at age 73 if you were born from 1951 to 1959, or at age 75 if you were born in 1960 or later. If you were born in 1950 or earlier, you are already required to take RMDs.

Because Roth contributions are made with after-tax dollars, Roth IRA owners are not required to take lifetime RMDs (Beneficiaries have different rules.) SECURE 2.0 extended this treatment to Roth accounts in employer-sponsored plans, effective for tax year 2024 and later.

If you are still employed, you may be able to delay taking RMDs from your current employer’s plan until after you retire.

Distribution Deadlines

Even though you must take an RMD for the tax year in which you turn 73 (or 75), you have a one-time opportunity to wait until April 1 of the following year to take your first distribution. For example, if you turn 73 in 2024, you must take an RMD for 2024 no later than April 1, 2025. You must then take your 2025 distribution by December 31, 2025, your 2026 distribution by December 31, 2026, and so on.

While it may be helpful in some cases to wait until the following year to take your first RMD, taking two RMDs in one year could put you in a higher tax bracket. It’s important to plan ahead and not be forced to take two distributions in one year just because you forgot to take the first one.

The penalty for not taking an RMD is 25% of the amount that should have been withdrawn. SECURE 2.0 reduced this from 50%, but it remains one of the steepest penalties in the U.S. tax system. The penalty is reduced to 10% if “timely corrected” by making up the missed RMD, generally in two years unless the penalty is assessed earlier.

Calculating RMDs

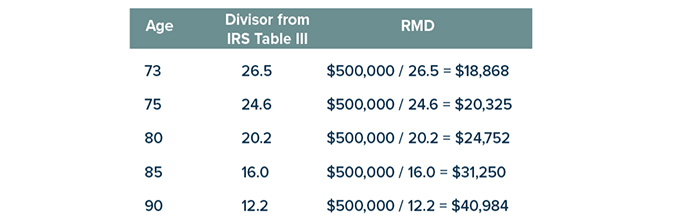

This example assumes a $500,000 traditional IRA balance each year. Note that as the divisor decreases at later ages, the RMD increases, assuming the account balance remains the same. In practice, the account balance may decline over time.

How Much to Take

Annual RMDs are based on the account balances of all your traditional IRAs and employer plans as of December 31 of the previous year, your age in the current tax year, and your life expectancy as defined in IRS tables. These tables were updated in 2022 to reflect longer life expectancies, which reduced the RMD at any given age.

Most people use the IRS Uniform Lifetime Table (Table III). If your spouse is more than 10 years younger and the sole beneficiary of your IRA, you must use the Joint Life and Last Survivor Expectancy Table (Table II). Table I is for account beneficiaries, who have different RMD requirements than original account owners. To calculate your RMD, divide the value of each retirement account balance as of December 31 of the previous year by the distribution period in the IRS table (see example).

If you have multiple tax-deferred accounts, calculating RMDs can be complex — one reason why it may be helpful to consolidate your retirement accounts. The IRA custodian or administrator of your retirement plan may provide information regarding your RMD for a specific account, but you might also consult with your tax professional.